It’s never too early to start building a strong financial future for your teen! Teaching children responsible money saving, spending, and budgeting habits from an early age gives them the foundation they need to kickstart their financial journey.

JHFCU’s Teen Account is the perfect introduction to financial independence and smart money management for your teenager, ages 13-17.

By opening our jointly owned Teen Account, you and your teenager can manage their money together.* This gives your teen a first glimpse at financial freedom while still keeping you in control of all transactions, usage, and more.

Give your teenager the gift of an early financial education that will last a lifetime.

Benefits of a Teen Account

✔ |

✔ |

✔The National Credit Union Administration (NCUA) insures your account for up to $250,000.

|

✔ |

✔ |

✔ |

Teen Account Details

Opening a joint Teen Account allows you and your teenager to manage their money together. It's a great way to learn about saving, budgeting, and handling money responsibly.

Here are the details you need to know:

- Free to open!

- No monthly fees

- Free E-Statements

- Parental Oversight

- No minimum balance requirements

- Manage your account online or through our mobile app

- Parent or guardian must be a joint account owner (The minor must have a valid state ID, student ID or passport to open a joint checking account.)

Teen Account Features

Free Debit Card

Gain hands-on experience making real-world purchases.

Bill Pay

Ensure on-time bill payments and simplified transactions.

Zelle®

Send and receive money between friends and family members, even if they bank somewhere different than you.**

Mobile Deposit

Skip the bank trip and deposit checks through our secure app.

30,000+ Free ATMs

That’s right, access to over 30,000 free ATMs nationwide.

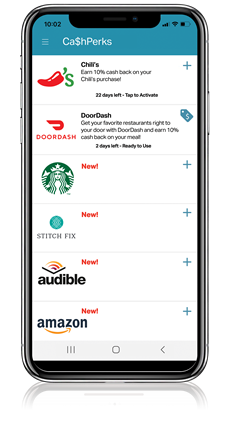

Start earning cash back

on select debit card transactions!

All you need is your JHFCU Visa Debit Card and Online Banking. Simply select the offers to activate them, and you’ll earn cash back on your purchases!

Start earning cash back (from a few cents to over $100) on select JHFCU Visa debit transactions.

Take advantage of as many offers as you’d like. And best of all, the system is secure and anonymous—your personal information is NEVER shared with the retailers, so you won’t be bombarded with any external solicitations.

To learn more, visit our Ca$hPerks page.

★★★★★

“Such a humanizing experience. They recognize you as a person and not just a number on a spreadsheet. Best feeling ever!”

- Joanna J.

Next Steps When Considering a

Teen Account

More Account Options

Young Adult Account

Money Market

1

Each offer comes with terms and limitations. Minimum purchase may be required; see offer for details. Some retailers limit the amount per offer, but there is no limit on the total amount you can earn from multiple offers. Cash back will be credited to your account the last day of the following month from which it was earned (e.g., cash back earned on purchases made in July will be credit the last business day in August). To opt out, simply click “Stop Receiving Offers.”

2 Subject to loan approval| Equal Opportunity Lender Federally Insured by NCUA | © 2024 Johns Hopkins Federal Credit Union

**U .S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC, and are used herein under license.