The ACH (Automated Clearing House) network provides a way to allow transactions to be debited from and credited to your Credit Union account much faster than checks (typically one to three business days). Using ACH payments can help reduce errors associated with writing and/or mailing. Essentially, ACH facilitates bank-to-bank transfers—the kinds of transactions that don’t go through credit or debit card networks. ACH is a low-cost way that financial institutions move money, thus is often the free option, e.g. with PayPal or other third-party payment processors.

Terms to know:

EFT Payment- Electronic Funds Transfer (EFT) payment is an umbrella term that includes ACH payments, wire transfers, and all other types of digital payments.

ACH - ACH stands for the Automated Clearing House and is the process of moving funds from one financial institution to another.

ACH Transfer - An ACH transfer is any electronic movement of money between financial institutions that use the ACH network. There are two kinds of ACH transfers: debit transactions and credit transactions.

ACH Origination - Occurs when a member allows an originating financial institution, company, or other authorized originator to debit directly from the member’s checking or savings account to make a payment to the recipient.*

ACH Debit Transfer - Occurs when money gets “subtracted” from the member’s bank or Credit Union account when the originator authorizes the recipient to withdraw money from the account. ACH debit transfers are items such as debit transfers to brokerage accounts, consumer payments on utility bills, insurance premiums, mortgage loans, and other bills. At JHFCU, you are unable to complete an ACH debit transfer from any account deemed a JHFCU “Savings” Account.*

For example, this kind of ACH transfer can happen when a member sets up a recurring loan payment and authorizes the Credit Union to debit a predetermined amount from the member’s bank account every month. Debit ACH transactions require members to provide his or her bank account information so that the funds can be pulled from their account. Click here to view the ACH Authorization – Loan Payment Form.

ACH Credit Transfer - Occurs when money is deposited into a member’s Credit Union account when the originator authorizes a financial institution to send money from its account to the recipient’s account.

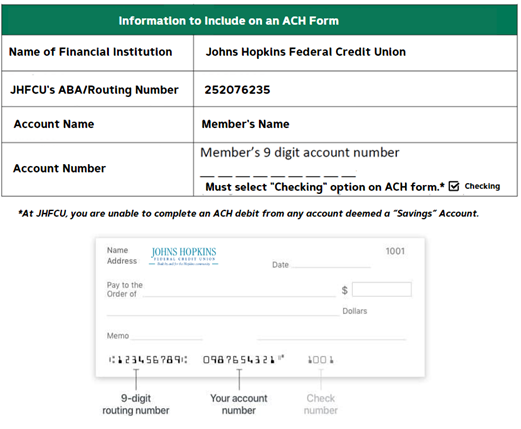

For example, a credit ACH transfer happens when an employee receives a regular paycheck via direct deposit or IRS refunds. The paycheck is deposited into the member’s account using an ACH transfer. To set up a Credit ACH transfer, ACH uses the amount as well as 3 pieces of the member’s Credit Union account information: the routing number, account number, and account type -- Savings or Checking.

How to find your ABA/Routing Number (some financial institutions have a separate ACH Routing number):

- Search online for the ACH ABA/Routing Number and your financial institution’s name.

- Logging into your financial institution’s online banking platform.

- Looking at a paper check and locating the 9-digit routing number as shown below.

ACH Transaction Processing Flow and Status

Pre-Note: ACH transactions may go through a basic account validation process to ensure that the routing number belongs to an actual financial institution prior to submitting a transaction for authorization. This pre‐note enables the originating institution to correct errors without being charged a transaction fee, and potentially an ACH Return fee. If a transaction fails the “pre-note” it will not be recorded in the system.

Every ACH transaction submitted is recorded in the system. ACH transactions can be assigned the following payment statuses as they move through processing stages:

Pending – The transaction has been sent to the receiving financial institution but has not posted because it is future dated.

Failed - Shows as rejected in the system. Rejected transactions can also be exceptions that need to be corrected.

ACH transactions typically take one to three business days to go through the processing stages.

How does an ACH transfer differ from a wire transfer?

Wire transfers are different from ACH transfers, even though both move money electronically from one bank account to another. ACH transfers are processed in batches at specific times throughout the day and can take a couple of days to settle. Wire transfers are handled individually and usually the money is sent within hours of the request** — no batching is involved. Instructions about the amount of money and the accounts involved are sent and cleared over a separate wire-processing system. Wire transfers have higher fees due to how quick the process is. For information on Outgoing and Incoming wires, please visit our Wire Transfers page.

*JHFCU allows the transfer of funds to a third party by means of a pre-authorized or automatic transfer. Pre-authorized or automatic transfers can be described as a transaction where authorization, verbal or written, was obtained by the originator to debit or credit the receiver’s account.

**Important: All JHFCU wire transfer requests are subject to call back verification, along with other variables. Address and Telephone numbers are required and must match what is on file. If your address and/or contact information has changed within the last 30 days, we may not be able to complete your request.